You are here: Home / Leadership Insights / Leadership / Economic headwinds persist, but inflation eases – A look at 2025

Economic headwinds persist, but inflation eases – A look at 2025

For small and medium-sized enterprises (SMEs), economic conditions play a critical role in shaping business strategy, investment decisions and long-term growth. While the economic outlook for Australia is for only modest growth, there are some positive signs, particularly in inflation and business investment. However, ongoing challenges such as at best modest GDP growth, labour shortages and global uncertainties continue to create a complex environment for business leaders. Understanding these economic trends can help SMEs navigate risks, seize opportunities, and build resilience in 2025 and beyond.

Economic activity was slow in 2024

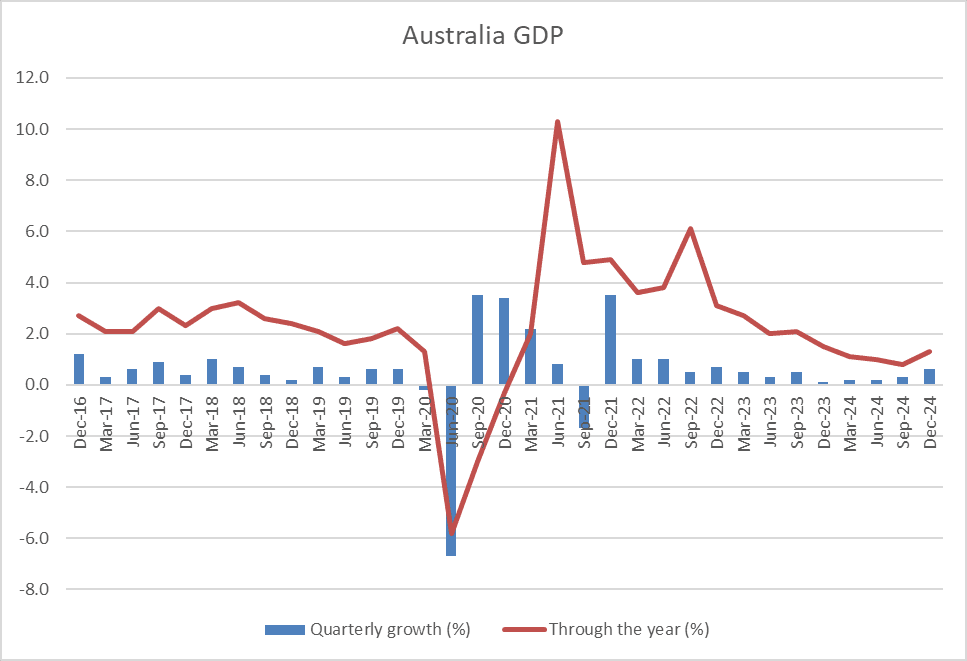

Australian GDP grew by a modest 0.6% in the December quarter 2024 and by 1.3% over the year. This shows still muted growth in the economy but is an improvement on the +0.2 and +0.3% rates of growth recorded in the previous quarters. It did however reflect a slow but positive +0.1% quarterly growth in GDP per capita, following seven consecutive quarters of declines. Government spending and public sector investment have been significant drivers of activity over the past year as well as making a large contribution to employment growth.

This relatively weak data at the national level is also reflected in the 80% of CEOs in our Vistage CEO Confidence Index who believe that economic conditions in their region are either the same or worse than the previous year. The survey did however reflect a little more optimism for the year ahead.

The chart below shows that, despite an uptick in the December quarter, economic growth in Australia has been weak since the recovery from the pandemic. This has had a dampening effect on revenue growth for most businesses.

The ABS has continued to report negative productivity growth which is acting as a drag on economic growth. The RBA has warned that “weaker incomes, soft consumer spending and higher inflation will persist if the economy’s flatlining productivity fails to rebound”.

One area that could help to boost productivity for SMEs is increased use of AI. 87.5% of respondents in the Vistage CEO Confidence Index see AI as offering ‘tremendous opportunities’. They see AI as delivering efficiency gains, cost savings and staff productivity.

A modest pickup in growth likely over 2025

The outlook is for a modest pick-up in activity in 2025, with recent signs suggesting that consumption is picking up, although still at subdued levels. The RBA has noted that the level of business investment has stabilised, and firms expect it to remain relatively steady over 2025. This is in keeping with the results of the Vistage CEO Confidence Index where, although 31% see a pick-up in investment spending, 51% expect it to remain steady. Also, like sentiments expressed by our CEOs, the RBA has said that it expects investment to be supported by take up of artificial intelligence, and investment in computer software and related products.

Business confidence as recorded by the NAB Business Confidence Survey is modestly positive but remains below the long-term average. In January, NAB reported that “despite an uptick in confidence, the survey showed a weakening across most activity metrics including capex. This suggests that while the level of demand has remained resilient, growth in the economy likely remains soft.”

Consumer confidence in Australia has also improved but remains at weak levels. The March Westpac Melbourne Institute survey recorded that “The recovery in consumer sentiment … regained momentum in March. The RBA’s decision to cut interest rates in February and a further easing in cost-of-living pressures have provided a clear lift”. The index is now at a “three-year high and just 4% off the ‘neutral’ level of 100, where there are the same number of optimists as pessimists.”

The RBA is forecasting Australian GDP growth to improve to a still modest 2.4% in 2025 and 2.3% in 2026. The OECD on the other hand sees growth picking up to only 1.9% this year but 2.5% next year.

Inflation has moderated but further interest rate cuts still uncertain

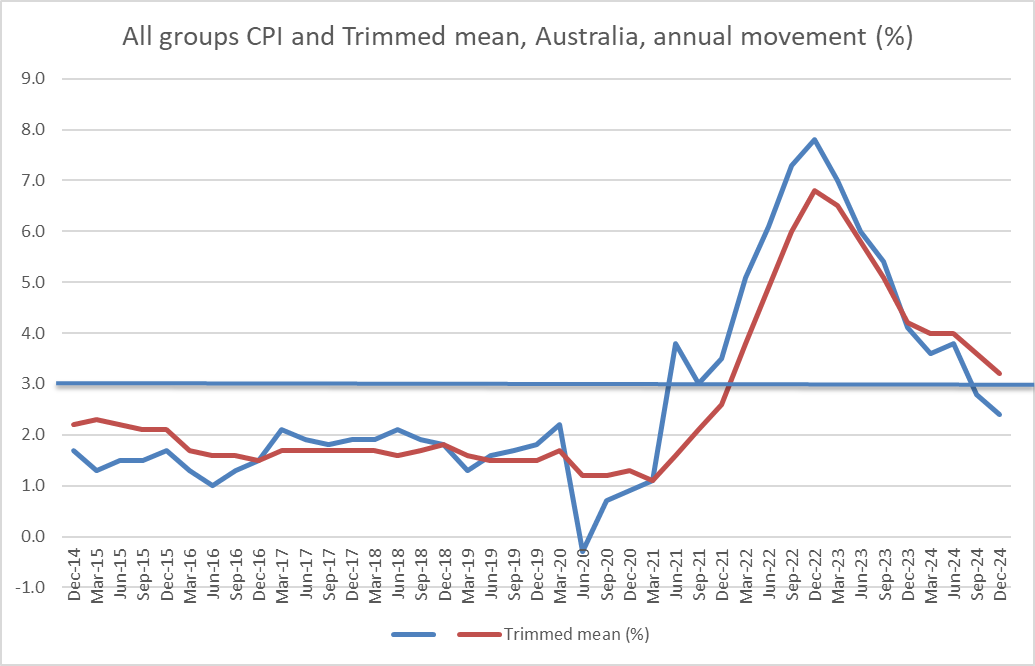

Headline CPI inflation was 0.3 per cent in the December quarter and 2.4 per cent over the year, down from 2.8 per cent in the previous quarter. The RBA has estimated however that changes to federal and state government subsidies, including electricity rebates, are estimated to have subtracted around 0.6 percentage points from year-ended headline inflation in the December quarter. When these subsidies finally end this will cause the headline rate to increase again.

The RBA’s outlook is for underlying inflation to fall to 2.75% by the end of this year, which is within their target band of 2-3%. If productivity growth does not improve, the RBA is concerned that demand will continue to outpace supply thus putting pressure on inflation. They are also wary of the tight labour market and resulting wage pressures. Inflation has picked up again recently in the USA and UK and this has resulted in central banks there slowing their expectations for rate cuts.

For SMEs, the uncertain outlook on interest rates means that borrowing costs may not decrease significantly in the near future. Businesses should continue to manage cash flow carefully and consider how potential cost increases could impact pricing strategies and profitability.

A slower pace of interest cuts than hoped for could also counter any improvement in cost-of-living pressures and would likely impact customer demand for SMEs in consumer facing industries or in the housing sector.

The chart below shows that headline inflation in Australia is now within the RBA’s 2-3% target range, although the RBA’s preferred measure, trimmed mean, (which excludes the most volatile items) is still slightly above the target. Certainly, inflation has now reduced enough for the RBA to make its first rate cut and further falls would help to put pressure for more rate cuts.

Employment remains strong

Unemployment in Australia has remained low and job vacancies are at high levels historically. This is reflected also in the responses from our CEOs who consistently talk about difficulties in finding staff. As noted by the RBA in its statement on monetary policy, much of the recent strength in employment growth has been driven by the non-market sector, but this has affected labour market conditions in the market sector. The unemployment rate has not risen as much as the RBA had been expecting and they have said that most near-term leading indicators do not point to much further easing in the labour market.

The ABS reported that job vacancies in November 2024 were 51.3% higher than they were in February 2020, prior to the start of the pandemic. They noted that the “ongoing high level of vacancies reflected the continuing labour shortages in many industries”. This is one of the key challenges being faced by SMEs now and is reflected in the responses in our Vistage CEO Confidence Index with many businesses mentioning finding and retaining staff as a key challenge.

This strong labour market adds to the RBA’s hesitation in proceeding too quickly with further interest rate cuts.

For SMEs, the tight labour market continues to pose challenges in hiring and retaining skilled staff. Business leaders should focus on employee retention strategies, workplace culture, and automation where possible to ease the burden of labour shortages. Competitive salaries, professional development opportunities, and flexible work arrangements may help attract and retain talent.

Global uncertainty clouds the outlook

The proposed tariffs being considered by US President Trump are adding to an uncertain global economic outlook. Significant tariffs would likely lead to a slower global economy. In fact, the RBA has stated that proposed US policy actions “pose material risks to the global economic outlook over 2025 and 2026”.

The uncertainties around global trade will likely impact many SMEs not just those exposed to the US market. Any impact on the Chinese economy would be particularly significant for Australia given it is our largest export market. Uncertainty is also likely to cause companies to hesitate on major investment plans. Tariffs would also add to global inflation pressures and could therefore delay further interest rate cuts in Australia and in other major economies.

Added to the policy uncertainty, continued global conflicts are also likely to continue pressures on major economies and add to hesitation of businesses to invest and grow.

Conclusion

Despite ongoing economic challenges, SMEs that remain agile and proactive can position themselves for long-term success. While inflationary pressures and global uncertainties persist, steady business investment and improving consumer confidence provide some optimism. To thrive in this environment, SMEs should focus on strategic investment, workforce planning, and leveraging technology to drive efficiency. Staying informed on economic trends, maintaining financial flexibility, and adapting to shifts in the market will be key to navigating the year ahead.

Author: David McDonald, CFA

David is a highly experienced economist, investment strategist, and communicator with a deep understanding of global and Australian financial markets. With a career spanning leading financial institutions and media, he excels at translating complex macroeconomic trends into clear, actionable insights for investors, businesses, and industry leaders.

CEO Confidence Index – March 2025 Report

The Vistage CEO Confidence index surveys small to mid-sized business CEOs and owners across Australia. The latest index results reveals the economic challenges facing Australian businesses and highlights AI’s potential.